Iron Ore Demand and Supply

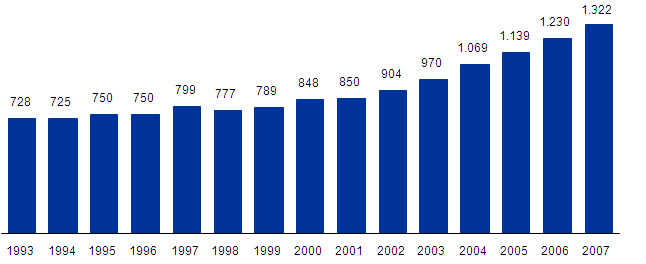

Iron ore and its by-products are the main raw materials used in the metallurgical industry, accounting for 77% of the consumer market, according to Sinferbase. In the last fifteen years, the annual production of crude steel has grown from 728 million tons in 1993 to 1.332 million tons in 2007, an annual average growth of 4.4%, according to IISI. The main factor responsible for this increase in the demand for steel products is China which, in less then three years, has become the world’s main market for these products, surpassing Europe and the US combined. The graph below shows global crude steel production (in millions of tons) for the period 1993-2007:

Fonte: IISI/World Steel Figures 2007

Today, China is the leading iron ore consumer in the world, due to its strong and consistent economic growth over recent years. Due to the size of the Chinese territory and its underdeveloped infrastructure (in terms of railroads, power plants, buildings and ports), such economic growth has led to an increase in investment in fixed liquid assets and urbanization, and this (in view of the large amount of steel required) has boosted the global demand for steel products and, consequently, for iron ore.

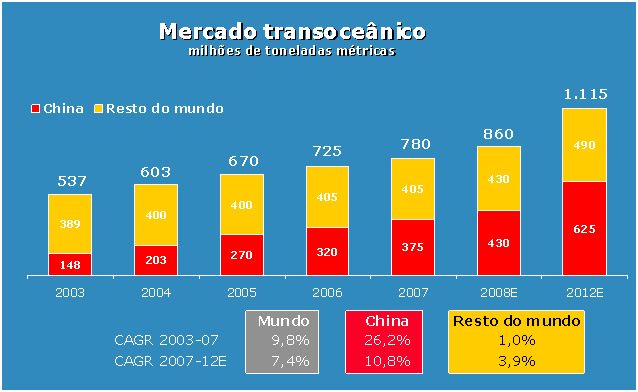

The graph below shows the development of the iron ore market and future expectations for its growth, both in China and the rest of the world.:

Fonte: TEX Report

The effect of the strong demand in China has been further intensified by a simultaneous increase in freight costs. These factors have caused the price of iron ore to rise to unprecedented values over recent years. Historically, freight costs have been determined by factors such as fuel costs, fleet capability, and negotiated balance of goods. Freight prices have also had an impact on the cost of raw materials, particularly for producers in the Southern Hemisphere, such as Australia and Brazil.

In spite of the significant growth in China’s iron ore production, which reached 600 million tons in 2007, according to Sinferbase, this expansion has not been sufficient to satisfy the strong growth in internal demand. The result has been a dependence on foreign supply, including iron ore from Brazil. In addition to this, China’s iron ore has a high cost of production, due to the mineral content of the cut ,which have an average iron content of 33% ( according to the China Iron and Steel Association) and the small scale of the country’s mines. The iron content of Chinese mines is below the world average of around 45%. In spite of having only the fifth largest iron ore deposits in the world, Brazil stands out for the quality of its extracted ore, which contains on average around 66% (60 to 67% in hematites and 50 to 60% in itabirites) according to DNPM data. The measure of iron concentration in the ore is a factor which determines its price per ton since the higher the concentration rate, the higher the iron ore profitability rate per extracted mineral ton.

Thus, since 2002, the strong Chinese demand has benefitted the global iron ore market by raising international prices. This, in turn, has led to the expansion of the productive capabilities of the world’s largest ore exporters, which include Australia, India, Brazil, South Africa and Sweden.

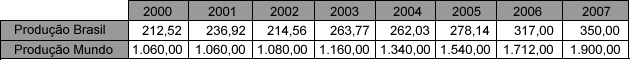

Brazil is the second largest iron ore producer in the world (it reached a production level of 350 million tons in 2007, 10.41% more than in 2006) and is responsible for 18.42% of global iron ore production. The table below shows the growth of iron ore production in Brazil and in the world, in millions of tons.:

Fonte: Sinferbase/USGS/DNPM

In 2007, Brazil’s iron ore exports totaled 258.5 million tons, of which 9.3% were exported to Germany, 12.8% to Japan, and 38.8% to China, according to Sinferbase. These three largest iron ore buyers received approximately 61% of the total iron ore exported in 2007.

In 2008, the global iron ore market continued to try to satisfy the demand created by the increase in steel production in China. In spite of the lavish geographic distribution of iron ore around the world, high quality resources are mainly concentrated in large deposits in Brazil, Australia, India and Western Africa. Therefore, most of the upcoming projects for expansion s are expected to be concentrated in these regions. The three largest iron ore producers - VALE, Rio Tinto and BHP Billiton , have announced investments to extend their operations over the coming years, with the aim of meeting the expected increase in global demand for iron ore.

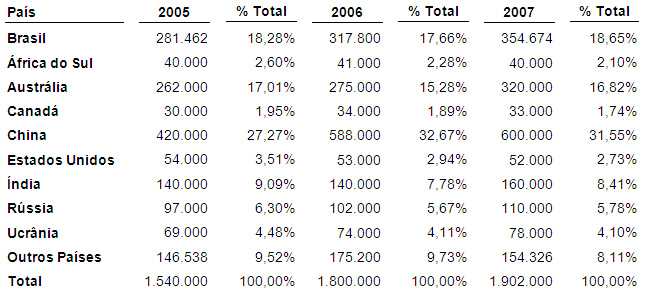

The table below shows global iron ore production between 2005 and 2007 (in millions of tons):